Examination of Legal Framework and Opportunities for Improving the Enabling Environment

Introduction

Regional connectedness is the key to overcoming past struggles and traumas and building a more decent future for everyone already living and coming to the region. Philanthropy holds the potential to do just that and makes it easier for people in the entire Western Balkans Six (WB6[1]) region to help and support each other by donating. Philanthropy plays a crucial role in the Western Balkans by providing immediate crisis response, contributing to long-term societal solutions, and fostering solidarity.

Local civil society organizations in the region heavily rely on external funding sources such as the EU, international organizations and funds, private foundations, and development agencies. However, there are efforts in each of the WB6 countries to improve the legal framework and encourage more philanthropic contributions from companies and individuals for social good causes. This not only provides more flexible funding options and diversifies funding portfolios, but it also helps to build trust, establish partnerships with local actors, and address the issue of donor dependency. In the political context of the WB6, where transitional or hybrid regimes[2][3] are common, these efforts are significant for civil society sustainability.

Philanthropy also plays an important role in promoting solidarity and building bridges among people in the troubled Western Balkans. While official statistics do not provide information on philanthropy tracking, Catalyst's Giving Balkans reveals an increase in philanthropy year after year. Cross-border philanthropy is hindered by unclear legal frameworks and ad-hoc decisions on tax relief, despite regional trade agreements like CEFTA and Open Balkans having lowered barriers for cross-border regional trade. However, Giving Balkans data shows that when a disaster strikes one part of the region, giving from neighboring countries is an automatic response of solidarity.

This study delves into Catalysts’ Giving Balkans January 2014 - March 2023 data to uncover the region's various donation patterns and trends. Ultimately, the study can reveal potential strategies for changes that can promote a more supportive and conducive environment for financial or in-kind contributions across the borders of the Western Balkans by addressing existing barriers and finding opportunities.

[1] The Western Balkans 6 consists of Albania, Bosnia and Herzegovina, North Macedonia, Montenegro, Kosovo and Serbia. All have a perspective to accede to the European Union and hence are also called 'enlargement countries.

[2] Freedom House (Accessed on June 1, 2023).

[3] Hybrid regimes are described as …typically electoral democracies that meet only minimum standards for the selection of national leaders. Democratic institutions are fragile and substantial challenges to the protection of political rights and civil liberties exist. The potential for sustainable, liberal democracy is unclear.

Source: Freedom House

Table of Contents

Key Findings and Recommendations

Overview of Regional Giving

Giving in the Western Balkans Six – Domestic vs. Cross-Border

Cross-Border Giving of WB6 - In Which Countries Where Donations Directed

Breakdown of Known/ Direct Donations to Other Countries per WB6 Country

Breakdown of Domestically Collected to Donate Cross-Border

Causes and Topics WB6 supports in the Region – Instances and Volume

Top Donor Category in Cross-Border Giving

Recipients (region, country specifics)

Regulatory Framework for Philanthropy in WB6

Larger Environment for Philanthropy - Regional Perspective

Taxation and Fiscal Issues – WB6 Country Profiles

Regulation and Solutions for Easier Cross-Border Donations

Recommendations

Conclusions and Initial Reflections on the Study Findings

Brief Methodology Review

Annex I - List of References

List of Abbreviations

Key Findings and Recommendations

These are some of the critical findings. More detailed and illustrated are in the following section:

- Total instances and volume of donations in the WB6 countries have decreased in 2021 and 2022, possibly due to COVID-19 donation fatigue and the economic crises, but the levels are still high compared to the pre-Covid-19 period. There is an expectation for 2023, with donations already catching up to previous years.

- Cross-border giving has increased in 2023, with 70% of total donations value going to other countries. The surge is primarily due to donations made for the earthquakes in Turkey. Giving also spiked in, for example, 2014 for Balkan floods and in 2019 and 2020 for COVID-19 and the earthquake in Albania.

- Apart from Albania, each WB6 country donated to each other WB6 country at least a minimal amount during the monitored period (2014 – March 2023).

- In the entire region, there are guidelines and regulations governing the creation, functioning, and termination of POs.

- In general, the political environment worsens for philanthropy organizations as countries continue to limit communication and partnering with the organizations.

- In general, the economic environment is hindered by the COVID-19 crisis, followed by the economic/energy crisis.

- The socioeconomic context in the region is characterized by the tradition of philanthropy and solidarity, as well as, in general, limited knowledge and lack of trust in institutional philanthropy.

- In WB6, there are no limitations on cross-border donations, but tax incentives are restricted, and bank transaction costs and registration procedures may differ for sending or receiving donations across borders.

Similarly to the findings, key recommendations are listed in the remainder of the section. The complete, more elaborated list is presented in a dedicated section at the end of the document:

- Connecting philanthropy with the existing regional networks and agendas can show how philanthropy can support solidarity and development in the Western Balkans.

- Making sure that actions contribute to the balanced development of the philanthropy ecosystem in the WB region.

- For easier circulation of cross-border donations in the region, starting synchronization of the regulatory framework for example, between two countries instead of six, is more cost-effective. Comparing regulations or creating a crowdfunding platform between two countries can be expanded to other countries later.

- Identifying and engaging philanthropy enablers can establish a cross-border network for donations in the WB region. Enablers can leverage the sector's strengths, promote communication, and facilitate cross-border donations.

- Multilevel networking and local support are crucial for creating a cross-country network. Engaging donors and improving the environment for philanthropy are necessary for success.

Overview of Regional Giving

The following analysis presents a snapshot of giving between countries and the perspective on donors, receivers, and causes motivating people and companies in the WB6 region to donate across borders.

Giving in the Western Balkans Six – Domestic vs. Cross-Border

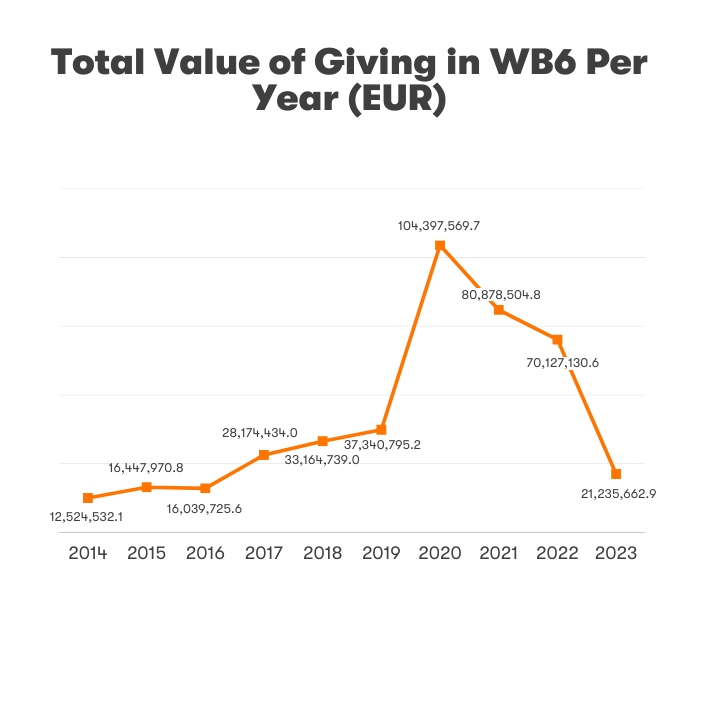

While there was a decrease in the total value of donations in WB6 countries as of 2021 and 2022, the volume is still far bigger than in the 2014-2019 period. This decrease may be attributed to donor fatigue resulting from extensive COVID-19 giving, especially in 2020 (more than 100 million EUR), along with the economic and energy crisis that followed. However, there is a more promising outlook for 2023 as the total volume of donations in the first quarter of that year is already more than half of what was donated in 2017 - 2019 (more than 20 mil. EUR in 2023 Q1 vs. less than in 40 million on 2017, 2018, and 2019), and more than donated in 2014-2016.

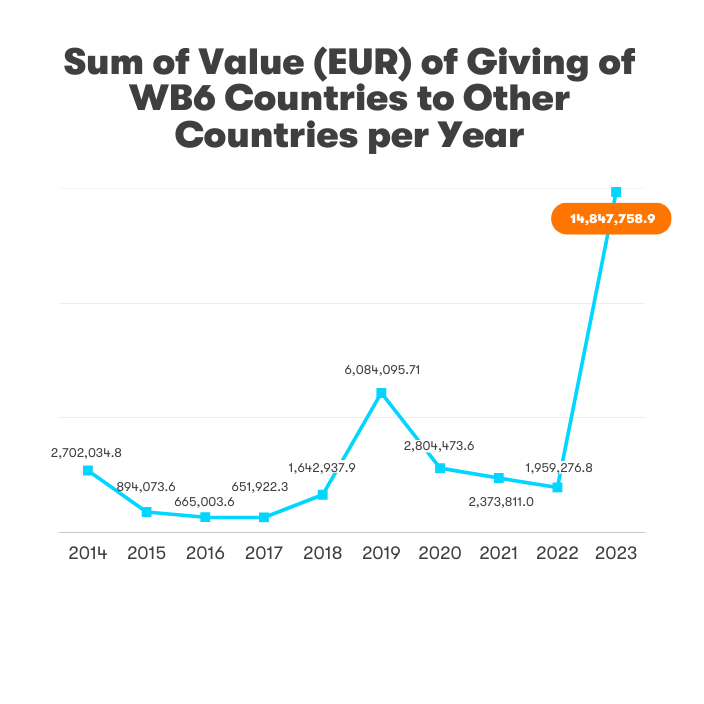

Regarding cross-border giving, 2023 is already a record year for giving to other countries, with 70% of being directed to other countries. This is primarily due to the massive contributions made to support Turkey after the devastating earthquakes in February 2023. Other peaks of giving are in 2014 and 2020, caused by floods hitting the Balkans in 2014 and the COVID-19 crisis and earthquake in Albania in 2019.

Figure 1 presents an overview of the volume of total giving of WB6 countries in 2014-2023

Figure 2 is an overview of the volume of cross-border giving of WB6 countries in 2014-2023

Cross-Border Giving of WB6 - In Which Countries Where Donations Directed

The following sections explain how each WB6 country distributed its donations to other countries in the WB region and elsewhere around the globe[4] in the examined period (from January 2014 to March 2023). It's important to note that the graphs only depict the ratio of instances of donations to recipients in other countries directly.

There are also donations collected domestically and transferred across borders, but the countries they were sent to are unknown. However, it is safe to assume that the allocation of these internally collected funds follows a similar distribution as shown in the graphs. For clarity, those internally collected funds are displayed separately in a table at the end of the section.

[4] For example, donations from BIH have reached forty-five countries, thirty-seven from Serbia, etc.

Breakdown of Known/ Direct Donations to Other Countries per WB6 Country

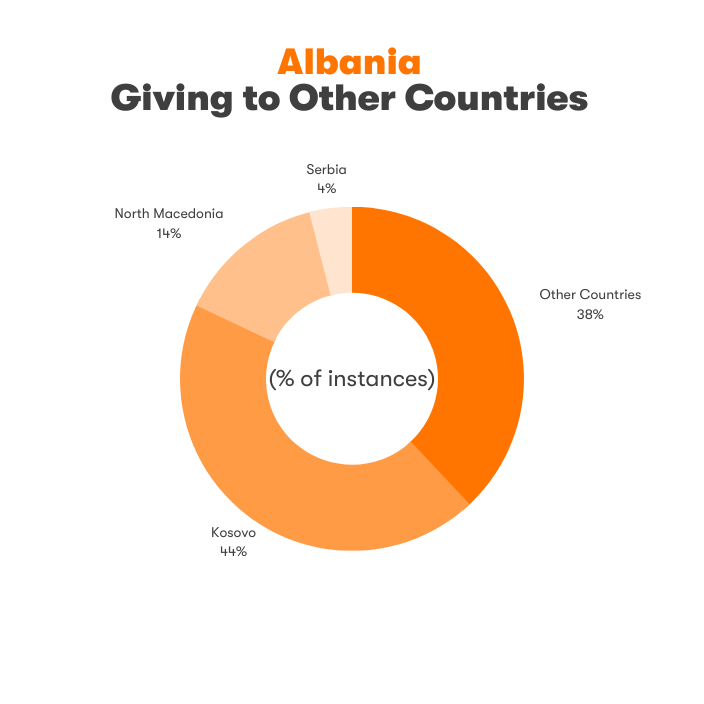

Albania

Albania is the only country for which donations were registered to only a few countries in the region, not all. Donations were directed to Kosovo and North Macedonia, with a smaller amount going to Serbia. In terms of other countries, most donations were directed toward Turkey (earthquake) in 2023. The situation is similar when taking the volume of donations into account.

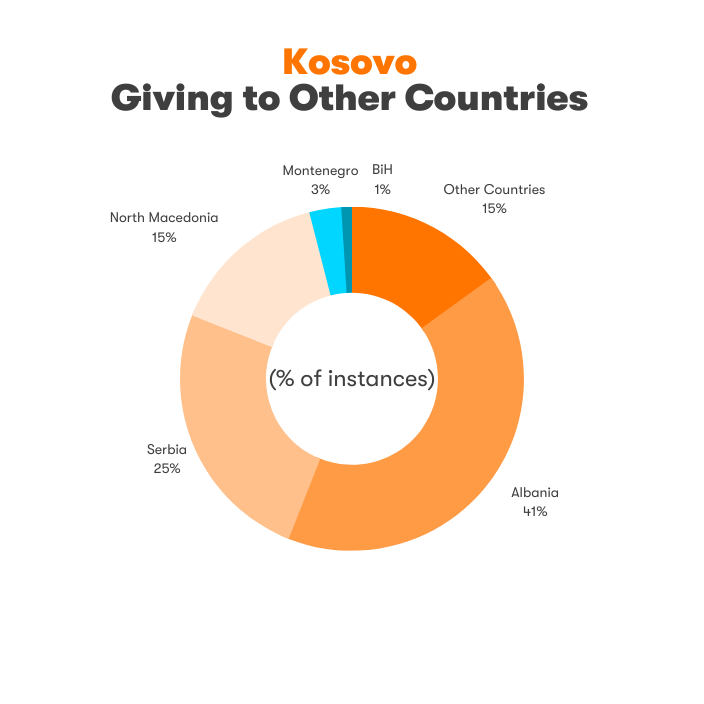

Kosovo

Donations from Kosovo to other WB6 countries have been recorded, but those to BIH and Montenegro are minimal compared to those directed toward Albania, North Macedonia, and Serbia. Turkey received the most cross-border donations to other countries, accounting for 6% of all recorded instances. When considering the volume of donations, Turkey is even more dominant, receiving 24% of all donations. Albania received 62% of the total.

Serbia

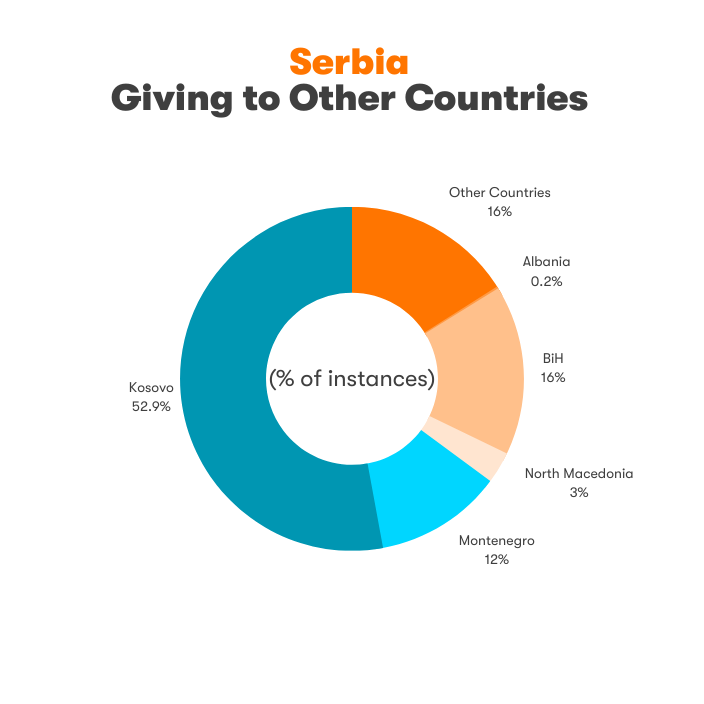

Serbia has donated to all other WB6 countries, but the donations to Albania have been minimal. Outside of the WB6, Italy (COVID-19), Croatia (earthquakes, particularly the one in Petrinja at the end of 2020), and Turkey (earthquake 2023) have the largest share of donations among non-WB6 countries, with 19%, 14%, and 11% of the total donations, respectively. Conversely, Kosovo has received the largest share of recorded donations, accounting for 16% of the total volume.

Montenegro

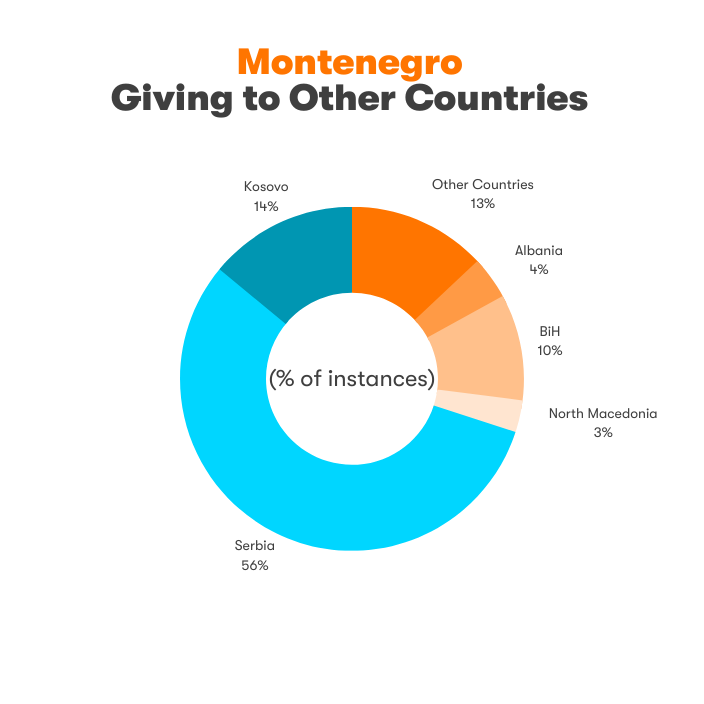

Out of the rest of the WB6 countries, Serbia received the most donations from Montenegro, followed by Kosovo, BIH, Albania, and North Macedonia. When it comes to other countries, Croatia stands out. The situation is similar when looking at the volume of donations – Serbia received a dominant 79% of cross-border Montenegro donations.

Bosnia and Herzegovina

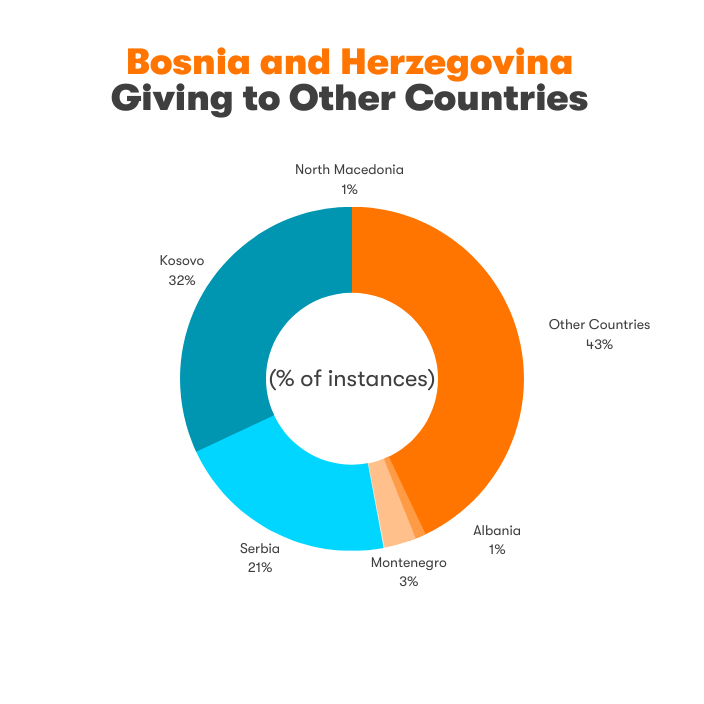

Kosovo and Serbia account for most donations from Bosnia and Herzegovina to other WB countries, while Montenegro, Albania, and North Macedonia received a smaller share. It is similar regarding the volume of donations; Kosovo and Serbia received 14% and 13%, respectively. But BIH is one of the WB6 countries that donates more to others (in total) than to an individual WB6 country. Instances of donations were recorded aimed at Croatia and Turkey (earthquakes), Syria, and Ukraine (refugees, war) the most.

North Macedonia

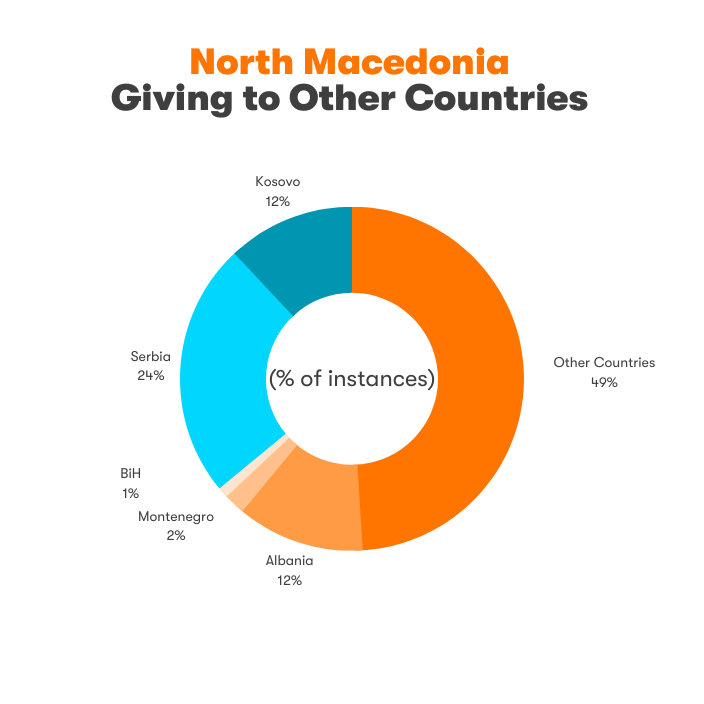

Like BIH, North Macedonia has more instances of donations towards other-then-WB6 countries than in the region – almost half of all instances. Serbia accounts for nearly one quarter, Albania and Kosovo received 12%, while BIH and MNE received insignificant instances. Other countries it is Turkey, Ukraine, and Croatia. However, it is different regarding the volume – 75% of donations were aimed at Albania, while Serbia received less than 1%, despite a significant share in the recorded instances. Turkey, with 16%, received a considerable portion of donations as well.

Breakdown of Domestically Collected to Donate Cross-Border

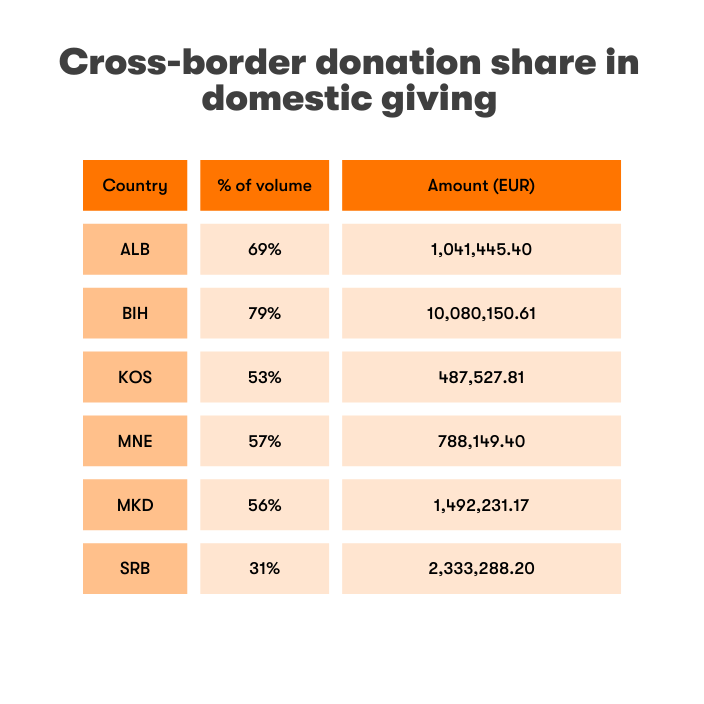

The table presents donations collected domestically (percentage of volume and the total amount) and transferred across borders per country.

Breakdown of Domestically Collected to Donate Cross-Border

Causes and Topics WB6 supports in the Region – Instances and Volume

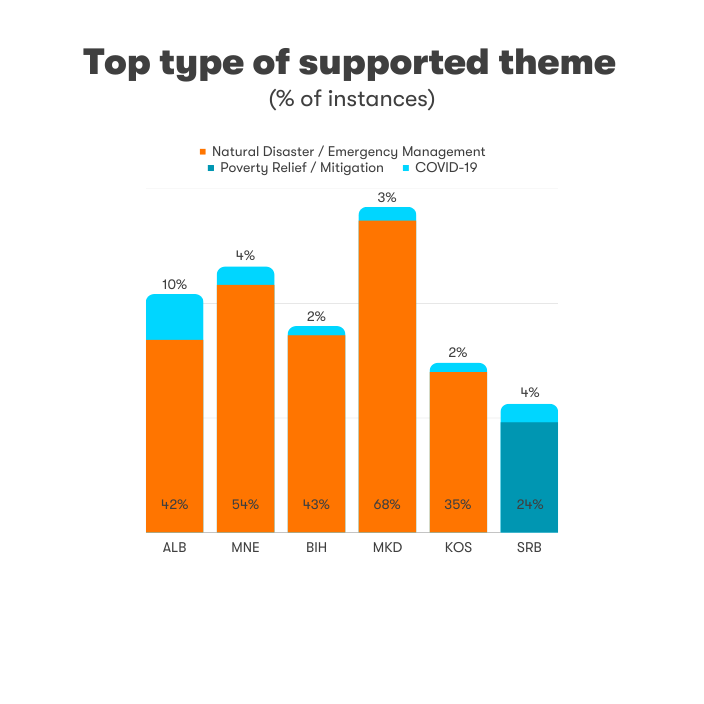

In line with the previous analysis, the WB6 countries showed the most significant response to Natural Disaster/Emergency Management in other countries, except for Serbia, which had a dominant focus on Poverty Relief/Mitigation. While COVID-19 sparked significant donations within each country, it did not result in substantial cross-border giving, except for Albania.

Figure 9 Top Type of Supported Themes - Percent of Instances

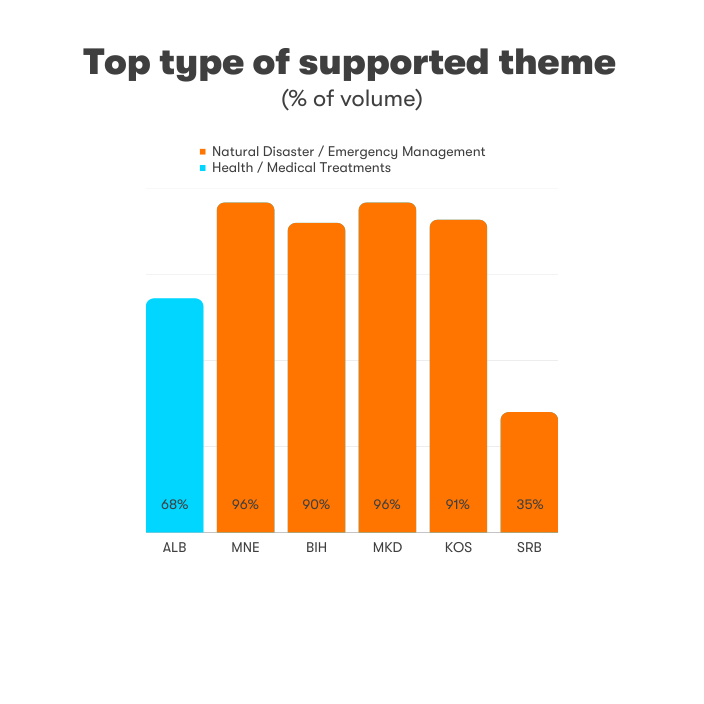

Regarding the volume the WB6 donated in the same period, Natural Disaster / Emergency Management remains the most dominant (even in Serbia, although less than in other countries). In Albania, however, most cross-border giving was targeted at Health / Medical Treatments.

Figure 10 Top Type of Supported Themes - Percent of Volume

Top Donor Category in Cross-Border Giving

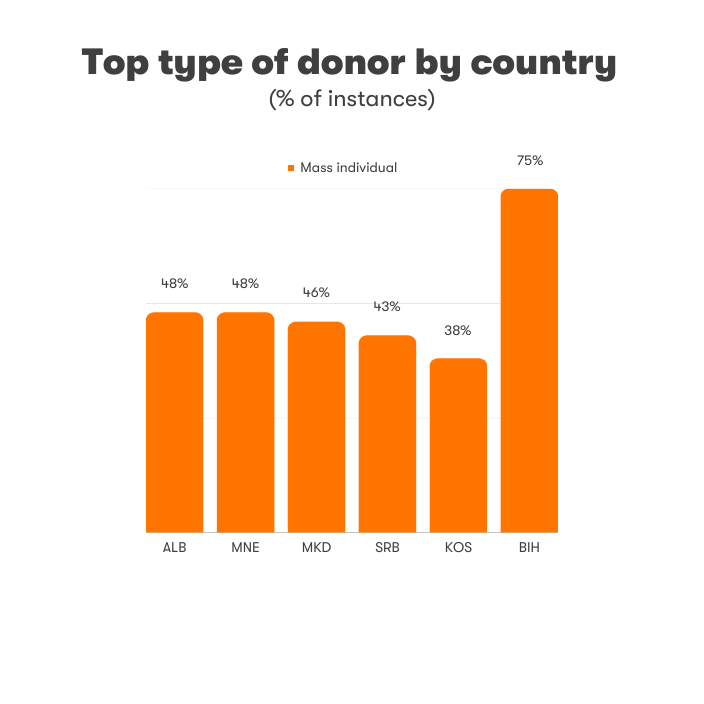

In WB6, citizens through mass individual giving are the most dominant type of donor when considering donation instances.

Figure 11 Top Type of Donor - Percent of Instances

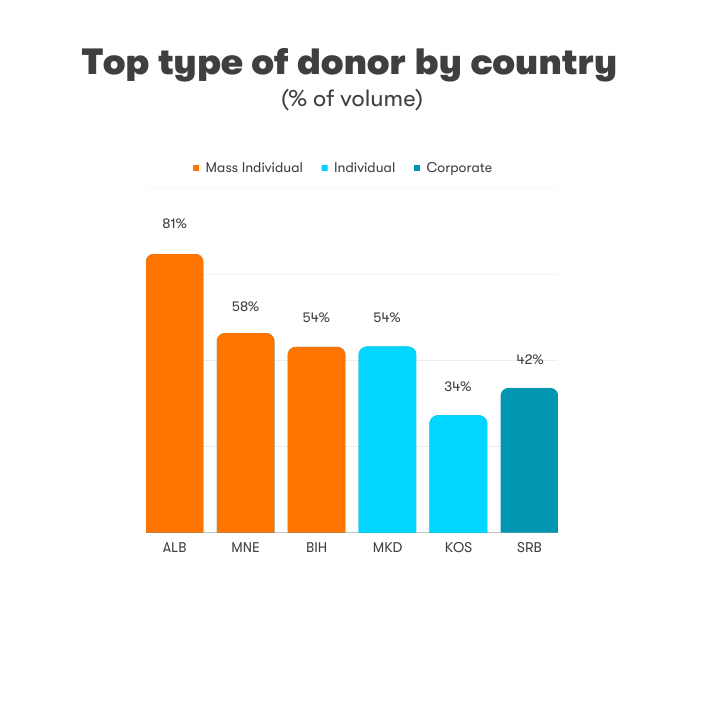

Regarding donation volumes, it is evident that the most significant donor category in ALB, MNE, and BIH remains to be citizens through mass individual donations. In MKD and Kosovo, individual donations dominate, while corporate donations are the primary contributors to the donation volume in Serbia.

Figure 12 Top Type of Donor - Percent of Volume

Recipients (region, country specifics)

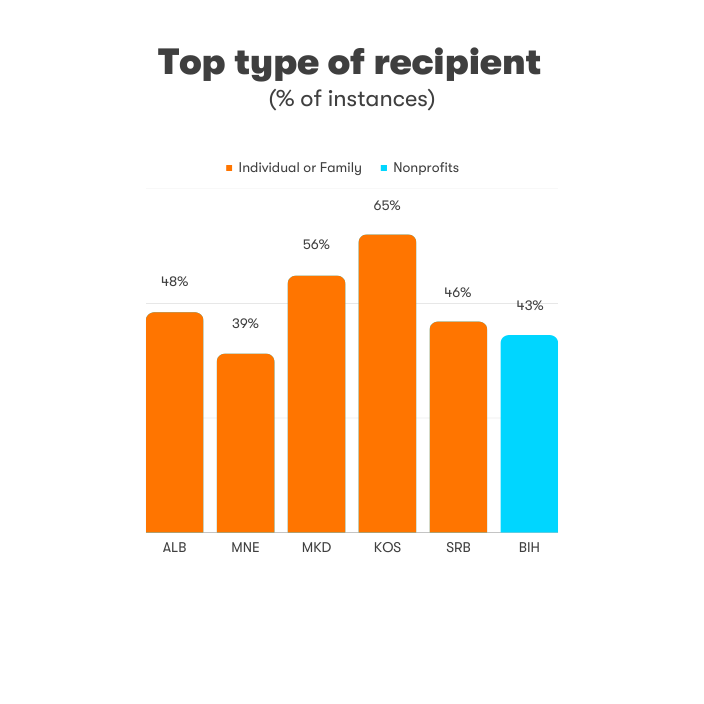

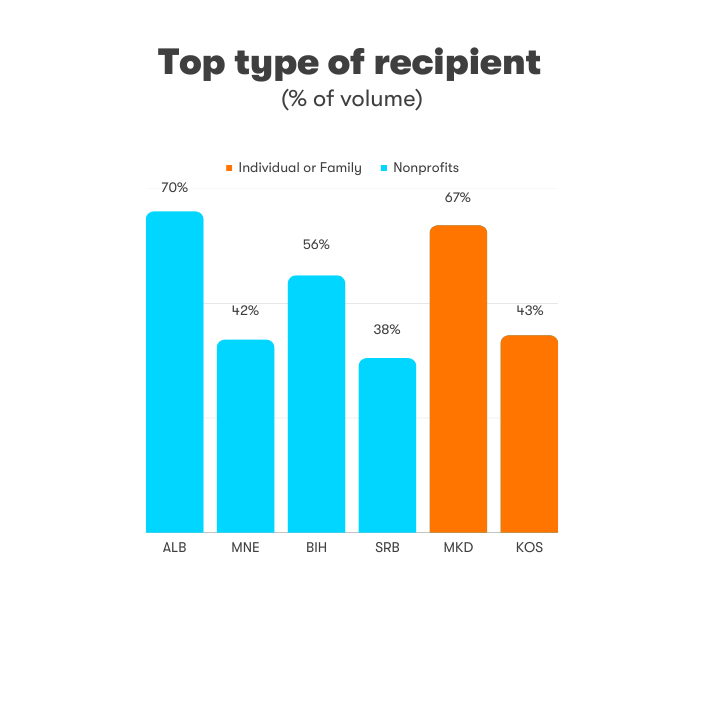

During the monitored period, the primary recipients of donations from six Western Balkan countries were individuals or families and nonprofit organizations. Donors from Kosovo and North Macedonia primarily donated to individuals or families in terms of both recorded instances and volume, while donors from Bosnia and Herzegovina mainly donated to nonprofits in both cases. In Serbia, Montenegro and Albania, there were more cases of giving to individuals or families, while nonprofits received a larger volume of donations from these three countries. It is interesting that for Montenegro and Kosovo, the second-largest recipient when it comes to the volume of donations, were authorities.

Figure 13 Top Type of Recipient - Percent of Instances

Figure 14 Top Type of Recipient - Percent of Volume

Regulatory Framework for Philanthropy in WB6

The 2022 Global Philanthropy Environment Index Region Report has revealed that the WB6 nations possess a moderately favorable environment for philanthropy. Although the regulatory environment for forming and operating a philanthropic organization (PO) is favorable, the tax policies for giving and receiving donations require improvement as the administrative processes can be burdensome, requiring considerable time and resources. Additionally, the relationship between governments and POs has become less supportive due to factors such as a decrease in public funds, government attacks on human rights organizations, a lack of transparency, or insufficient promotion of philanthropy.

Following the Global Philanthropy Environment Index Methodology, the following aspects of the enabling environment for philanthropy will be analyzed at the regional level:

- Formation/Registration, Operations, Dissolution of a Philanthropic Organization

- Political Environment

- Economic environment

- Socio-Cultural Environment

Taxation, directly affecting giving in WB6, will be analyzed country by country. A general view on opportunities (or lack of) for WB6 cross-border donations, as well as different examples of regulation and solutions for easier cross-border donations, are provided at the end of the section.

Larger Environment for Philanthropy - Regional Perspective

Formation/Registration, Operations, Dissolution of POs

Throughout the region, there are consistent and unambiguous rules and regulations regarding establishing, operating, and closing POs. However, Albania introduced a new law concerning anti-money laundering and anti-terror financing in 2019. This law, Law No. 33/2019, classified POs as high-risk for money laundering and terrorism financing, mandating them to conduct risk assessments to prevent excessive government supervision. In Serbia, fifty-seven CSOs (including POs) and independent media were investigated by the Serbian Administration for the Prevention of Money Laundering and Terrorist Financing (APML) in 2020. Shortly after one state-affiliated print tabloid published an eight-page supplement on those organizations, questioning their funding sources and missions, it seems that this was the only reason those organizations were investigated.

Political Environment

As mentioned earlier, Freedom House classifies each of the WB6 countries as having a Transitional or Hybrid Regime in terms of their democratic state, and the political climate for philanthropy in the WB6 region could use improvement. The relationship between country governments and POs appears to be fragile in the area. Transparency in cooperation, decision-making, and funding processes has decreased in Albania and Montenegro. In Serbia, tension between the government and various types of CSO has risen. The dedication to promoting philanthropy has decreased in North Macedonia and is absent in Bosnia and Herzegovina.

Public funding allocated to POs has significantly decreased in countries like Albania and Serbia due to the COVID-19 pandemic and has remained low, While the economic environment for POs has improved in Kosovo and Montenegro in recent years. Kosovo and North Macedonia have implemented new strategies and action plans to enhance civil society, providing opportunities to improve the political climate for philanthropy.

USAID's CSO Sustainability Index evaluates the Financial Viability of CSOs, including POs, as the least developed dimension out of the seven it monitors in each of the WB6 countries[5] in 2021. However, the Legal Environment in the region is relatively better assessed, except for in Serbia and North Macedonia.[6]

Economic Environment

Countries in the region face difficulties in effectively fostering their economies due to mismanagement, corruption, and high unemployment. Unfortunately, calamities such as the 2019 earthquake in Albania and the COVID-19 pandemic have made the situation worse, impeding the economic progress that some countries had begun to experience. As a result, there is less room for donations. The economic and energy crisis that followed, along with the escalated inflation rates, further hindered the economic development in the WB region.

Socio-Cultural Environment

The Western Balkan countries have a rich tradition of philanthropy and solidarity, which is also characterized by their societal values and religious diversity. The people in the region exhibit a strong sense of unity and willingly contribute to their communities. However, donors in the area seem to have limited knowledge about POs and lack trust in institutional philanthropy, although this is gradually changing as more organizations adopt various fundraising techniques and are trying new approaches. In Montenegro, a poll organized in 2019 showed that more individuals trust that funds raised for philanthropic activities are utilized appropriately compared to 2012.

Taxation and Fiscal Issues – WB6 Country Profiles

Albania

Moving capital or cash across borders is generally unrestricted, except for regulations related to money laundering that require proof of funding or payment. However, it's important to note that corporate tax deductions and exemptions for donations made within a country do not apply to cross-border donations. In-kind donations are treated like other exported goods and are subject to VAT and customs duties. POs may receive an exemption from custom VAT for certain imported goods but not for exports.

Bosnia and Herzegovina

Legal entities that donate to public interest sectors are granted tax incentives through tax deductions, as determined by applicable regulations. The amount of tax deduction is calculated based on the total income of the legal entity taxpayer. Both cash and in-kind donations made by legal entities are exempt from taxation. Similarly, donations made by individuals are also exempt from taxation.

Kosovo

In Kosovo, individuals, corporations, and donations from other sources can receive a 10% deduction on their taxable income if they donate to eligible recipients in humanitarian aid, health, education, religion, science, culture, environment protection, and sports. These eligible recipients include non-commercial organizations and CSOs directly engaging in activities related to the areas mentioned above. However, the provisions for CSOs in the Law on Corporate Income Tax are unclear as it is not specified whether the exemptions on standard corporate tax apply to all CSOs or only those with Public Benefit Status.

Montenegro

Legal entities can receive tax incentives through tax deductions for donations made in areas of public interest. The total gross income of the legal entity is used to calculate the deduction for these donations. Additionally, donations made by legal entities in the form of cash, goods, and services are exempt from taxation. Likewise, donations made by individuals are also exempt from taxation.

North Macedonia

Legal entities that donate in public interest areas can receive tax incentives in the form of deductions. The deduction is calculated based on the total income of the entity. Furthermore, legal entities are exempt from paying taxes on donations made in the form of cash, goods, or services.

Serbia

In Serbia, a company’s donations can be deducted as expenses on its tax balance sheet based on Article 15 of the Profit Tax Law. The law allows for deductions of up to 5% of the company's total income for expenses related to healthcare, education, science, humanitarian efforts, religion, sports, environmental protection, and contributions to social protection institutions or providers. Unfortunately, individuals do not receive any tax incentives for donations, which are not exempt from taxation. Monetary donations are not taxable.

Regulation and Solutions for Easier Cross-Border Donations

Western Balkans Practice

In the WB6, there are no limitations on cross-border donations. However, tax incentives are restricted, and bank transaction costs and registration procedures may differ for sending or receiving donations across borders. In most countries in the region, cross-border donations are not eligible for tax deductions. Nevertheless, in Kosovo, POs can enjoy VAT exemption for charitable donations sent in kind. In North Macedonia, tax deductions are applicable for cross-border donations to natural or humanitarian disasters. POs in the WB6 can receive cross-border donations without any restrictions and often receive similar tax incentives as domestic charitable contributions.

EU Practice

In most EU countries, cross-border donations are not encouraged as a standard practice. While there is a non-discrimination principle in the tax law regarding public-benefit activities, each member state can establish its own regulations. However, some specific scenarios may qualify for a subsidy if the foreign entity meets specific domestic and/or international criteria, and some member states did introduce some incentives.

To address this issue within the EU and simplify cross-border donations, the Transnational Giving Europe Network connects across borders and enables tax-efficient cash donations in 20 EU countries – as a network, it is an established legal structure in different European countries where the donors reside. The network thus enables donors, corporations, and individuals residing in one of the participating countries to financially support non-profit organizations in other member countries while benefiting directly from the tax advantages provided for in the legislation of their country of residence.

Experience in Parts of Asia and Australia

In many South, South-Eastern, East Asian Countries and Australia, charities face specific and stringent restrictions when operating abroad. Governments in the region are concerned about money laundering and terrorism financing, which has led to increased oversight of overseas giving. Restrictions can include requirements for government approval for the use of funds, banking regulations on transactions, and additional reporting requirements for cross-border funding and activities. While these controls are necessary to prevent unlawful transactions, there is often no clear compliance checklist, which can cause significant concerns for donors.

The region is home to many of the world's wealthiest individuals and a prime target for major donors and philanthropists. With a combined population of nearly 3 billion people in India and China alone, the region faces significant global issues that require attention. However, navigating different regulations and language barriers and building strong relationships with donors pose additional challenges. This region still has to create more efficient cross-border donations, and priorities can be better regulation and building the philanthropy infrastructure promoting the culture of philanthropy.

Bilateral Agreements

In certain circumstances, donating to a foreign PO can result in tax relief and other incentives if countries have bilateral agreements to allow for such relief. For instance, the United States has agreements with Canada, Mexico, and Israel that facilitate this process. Similarly, the Netherlands and Barbados, as well as Mexico and Barbados, have provisions in their treaties that allow for such donations to receive tax relief.

Recommendations

RAISING AWARENESS OF PHILANTHROPIC GIVING IN THE REGION

As much as awareness and knowledge on philanthropy are needed on the local and national levels, they are required on the regional as well, among all stakeholders. Civil society, companies, public servants, citizens, and those involved in regional activities and projects, in particular, should be target audiences for narratives emphasizing opportunities for giving between countries with shared interests and cultivating a giving culture that focuses on positively impacting the region.

MORE REGIONAL RESEARCH ON GIVING

There is a need for further research to enhance the understanding of philanthropy by analyzing data to determine its functionality, drivers, and potential challenges to its development. It would be beneficial to conduct comparative regional studies, delving deeper into philanthropic actions' motives, mechanisms, volumes, and impact.

COMPARATIVE REGIONAL POLICY/ REGULATORY ANALYSIS

When conducting comparative policy analysis in WB6 countries, it is essential to consider regulations related to preventing money laundering and financing terrorism and laws regarding customs, taxation[7], income, civil society, and foundations. Additionally, it's essential to examine laws governing the entry and stay of foreigners.

STRATEGIC APPROACH TO DEVELOPING CROSS-BORDER PHILANTHROPY IN WB6

Being strategic in approaching developing cross-border philanthropy in WB6 includes the following aspects:

- Setting long-term, flexible advocacy plans, which take into consideration that every effort to adjust policies or practices in the WB6 means political decisions which have to be allowed from the top and should be in line with the EU enlargement and other cross-border initiatives;

- The push, the evidence, and the demand must come from the “bottom” as the clear voice of the people of the WB6;

- The existing networks and regional agendas, like the Green Agenda for the Western Balkans, Open Balkans, The Western Balkans Action Plan, or regional environmental or youth networks, could be utilized as vehicles to showcase how philanthropy can contribute to solidarity and development in WB6, regarding various pressing issues and opportunities for development, and for including philanthropy in discussions to contribute in the recovery and development of communities in the region.

- Making sure that actions contribute to a balanced development of the philanthropy ecosystem in the WB region.

BILATERAL SYNCHRONIZATION FIRST

Before reaching this “WB6 Philanthropic Harmony”, let’s consider starting by synchronizing on the bilateral level. Comparing the regulatory framework will be much easier between two countries than six; creating approaches that would facilitate easier transfers of humanitarian relief between two countries can be accomplished faster than for six. Researching and finding solutions that can help increase giving between two WB6 Countries and then scaling it up to other countries in the region could save time and money and allow for testing different solutions.

PHILANTHROPY ENABLERS FOR REGIONAL PHILANTHROPY

Identifying and engaging philanthropy enablers at a national level can initiate talks to establish a transnational network for donations in the WB region. They hold a crucial role in tapping into the various strengths of the sector, promoting communication, sharing successful strategies, and fostering cross-border donations at a regional level.

BUILDING STRONGER CONNECTIONS

To establish a network spanning multiple countries in the region, it is crucial for the broader ecosystem to work together and supply the essential local infrastructure and assistance. This entails involving donors in regional matters and procedures, enhancing the overall atmosphere for cross-border philanthropy. In that regard, SIGN Network can play a crucial role in connecting regional stakeholders, offering access to local knowledge and expertise, and helping advancement the culture of giving in the region.

[5] Apart from Serbia, in which Financial Viability is at a similar level as in other WB& countries, but Public Image, for example, is evaluated as more problematic.

[6] Remaining five dimensions are Organizational Capacity, Advocacy, Service Provision, Sectoral Infrastructure and Public Image.

[7] Of monetary donations as well as frequently donated goods like medication, medical devices, construction materials, and equipment.

Conclusions and Initial Reflections on the Study Findings

POTENTIAL FOR PHILANTHROPY

People and companies from WB6 are ready to give to other countries and countries in the region.

Despite the challenges posed by the COVID-19 pandemic and other crises, the philanthropic spirit of the region has remained strong. Moreover, While the volume of giving has decreased (but still is much larger than before 2019), there has been a noticeable increase in philanthropic donations to other countries, especially in 2023. This trend is particularly impressive given the lack of incentives provided by the regulatory framework for both national and cross-border giving. Also, this increase in philanthropy is happening even though many people in the region still need to gain knowledge about the philanthropy of Both (potential) donors and (potential) receivers of donations. Other stakeholders also do not fully understand the impact of philanthropy.

CLOSEST NEIGHBORS OR ETHNIC AND RELIGIOUS CONNECTIONS

When looking at the available donation patterns among the WB6 countries, it becomes apparent that donations are more likely to occur between neighboring countries than those further apart. For instance, there were no registered donations from Albania to Bosnia and Herzegovina, and just some insignificant donations from Bosnia and Herzegovina to North Macedonia. However, there were no recorded donations from Albania to Montenegro, even though they share a border. One possible explanation for this trend is that donations are based less on the proximity of the recipients and more on shared ethnic and/or religious identity. Although there is no sufficient and concrete data to confirm this, the history and the present ethnic and religious divisions in the region – or the lack of multiculturalism, contribute to this explanation. If this is true, more solidarity, understanding, and acceptance of different cultures in the region will allow for more support (donations) within the region. Or maybe it is the opposite – could philanthropy contribute to greater collaboration and support among all countries?

Brief Methodology Review

This report was prepared using the Giving Balkans database, which remains the region's most reliable database on philanthropic giving. Due to the absence of official data (e.g., the Ministries of Finance or Tax Administration), Catalyst Balkans uses alternative ways to collect data, primarily media reports and donor and recipient reports. From January 2014 to March 2023 (first quarter), reports were compiled by monitoring printed, electronic (radio and TV), and online media at the local, regional, and national levels in six WB countries.

It's important to note that the methodology used has its limitations since there can be a discrepancy between the actual situation and the recorded data. Moreover, the media's reporting on philanthropic efforts is not all-encompassing, and the media monitoring method (using media clipping) employed also cannot provide a complete picture. Nonetheless, our research provides a sufficiently reliable insight into the most critical aspects of philanthropic giving because figures, although not comprehensive, offer a minimum value for relevant indicators. For example, if we discuss the number of charitable instances, we can state with certainty that the number we show is the minimum number of instances that have occurred. The same is true for the amounts, actors, and other data. Hence, this data may be used to indicate the minimal degree of philanthropy development.

A range of secondary sources has been consulted to gain a deeper understanding of philanthropy in the Western Balkans and its potential for cross-border impact. These sources include reports on the state of philanthropy and civil society development, country profiles, policy analysis, and similar materials. By examining these sources, we have tried to understand better the nuances of the different contexts and regulations that shape philanthropic activities in the region and identify opportunities for collaboration and growth.

Annex I - List of References

- Catalyst Balkans. (n.d.). Giving Balkans Database.

- Trag Fondation. (2021). Filantropska agenda 2.0.

- Indiana University Lilly Family School of Philanthropy. (2022). The Global Philanthropy Environment Index 2022.

- OECD. (n.d.) The tax treatment of cross-border philanthropy.

- Legal environment for philanthropy in Europe. (2020). Albania Country Report 2020.

- Give2Asia. (2022). UNLOCKING CROSS-BORDER PHILANTHROPY IN ASIA AN ASSESSMENT OF DONOR INTEREST & INFRASTRUCTURE READINESS.

- Transnational Giving Europe. (2021). Annual Report 2021.

- KCSF. Monitoring Matrix on Enabling Environment for Civil Society Development. Country Report for Kosovo 2019.

- Indiana University Lilly Family School of Philanthropy. (2023). 2023 Global Philanthropy Tracker.

- European Commission. (2022). Albania 2022 Report.

- European Commission. (2022). North Macedonia 2022 Report.

- European Commission. (2022). Kosovo 2022 Report.

- European Commission. (2022). Bosnia and Herzegovina 2022 Report.

- European Commission. (2022). Montenegro 2022 Report.

- European Commission. (2022). Serbia 2022 Report.

- Indiana University Lilly Family School of Philanthropy. (2022). The 2022 Global Philanthropy Environment Index Albania.

- Indiana University Lilly Family School of Philanthropy. (2022). Country Report 2020: North Macedonia.

- Indiana University Lilly Family School of Philanthropy. (2022). The 2022 Global Philanthropy Environment Index Bosnia and Herzegovina.

- Administration for the Prevention of Money Laundering. (2017). Annual Report of the Work of the Administration for the Prevention of Money Laundering for the period from 1.1.2016. to 12.31.2016.

- Radovanovic, B. (2015). Practices of Individual Giving in Serbia, 7th International Conference of the European Research Network on Philanthropy (ERNOP), 9 – 10 July 2015, Paris.

- Radovanovic, B. (2019). Volunteering and Helping in Serbia: Main Characteristics. Sociologija, 61 (1), 133 – 152.

- Galjak, M. (2019). Philanthropy in the Western Balkans: A Network Analysis Report on Giving in the Region, 9th International Conference of the European Research Network on Philanthropy (ERNOP), 4 – 5 July 2019, Basel.

- Grahame Barker, A. (2013). Risks of the Exploitation of Nonprofit Organizations for Money Laundering and Terrorism Financing in Serbia. Belgrade: Council of Europe.

- Decision on the Minimal Standards of Activities of Banks in the Prevention of Money Laundering and the Financing of Terrorism, Official Gazette BIH No. 68/2012.

- Balkan Civil Society Development Network. (2019 October). Growing Pressure on Civil Society and What To Do About it?. BCSDN.

- Vesić, A., Bueno Momčilović, T. & Koeshall, N. (October 2019). Western Balkans Public Opinion on Philanthropy: Comparative Analysis. Belgrade: Catalyst Balkans, Trag Foundation, fACT Montenegro

- Centre for Development of Non-Governmental Organizations. (2020). Attitudes of Montenegrin Citizens on Non-Governmental Organizations. Podgorica: CRNVO.

- Nonprofit Law in Serbia. (2020).

- Trag Foundation. Legislative Framework for Donations.

- USAID CSO Sustainability Index Explorer.

- Maarten Lemstra, (2020). Policy Brief - The Destructive Effects of State Capture in The Western Balkans. EU Enlargement Undermined, The Hague, Clingendael Institute

- Freedom House Nations in Transit report

- Dragan Sreckovic, (2020) Youth Transformative Potential in the EU Integration Processes and Post-Covid-19 Developments in the Western Balkans (Comparative Study), Belgrade, Serbia, Center for Democracy Foundation.

List of Abbreviations

This report is prepared within the Project "Protecting Civic Space – Regional Civil Society Development Hub" financed by Sida and implemented by BCSDN.

The content of this document and information and views presented do not represent the official position and opinion of Sida and BCSDN. Responsibility for the information and views expressed in this document lies entirely with the author(s).

Leave a comment